Financing Your Future: A Guide to Student Loans

By: Carol Ann Aldridge, CCUFC

Published: 06/09/2020

According to a recent article in Forbes Magazine, the latest statistic states that student loan debt is at an all-time high. It is estimated that the amount of student loan debt for U.S. borrowers topples $44.7 million dollars, with the average student owing about $33,000. The U.S. Department of Education’s federal student loan program, otherwise known as William D. Ford Direct Loan Program, is a great option for students who otherwise would not be able to afford higher education or qualify on their own for private loans. However, many students are not educated about this investment in their future.

The William D. Ford Direct Loan program includes three types of direct loans offered to students:

-

Direct Subsidized Loans

- Eligible to undergraduate students who demonstrate financial need

-

Direct Unsubsidized Loans

- Eligible to undergraduate, graduate and profession students, but not based on financial need

-

Direct Loans PLUS Loans

- Eligible to graduate students or parents of a dependent undergraduate students, not based on financial need, but a credit check is required

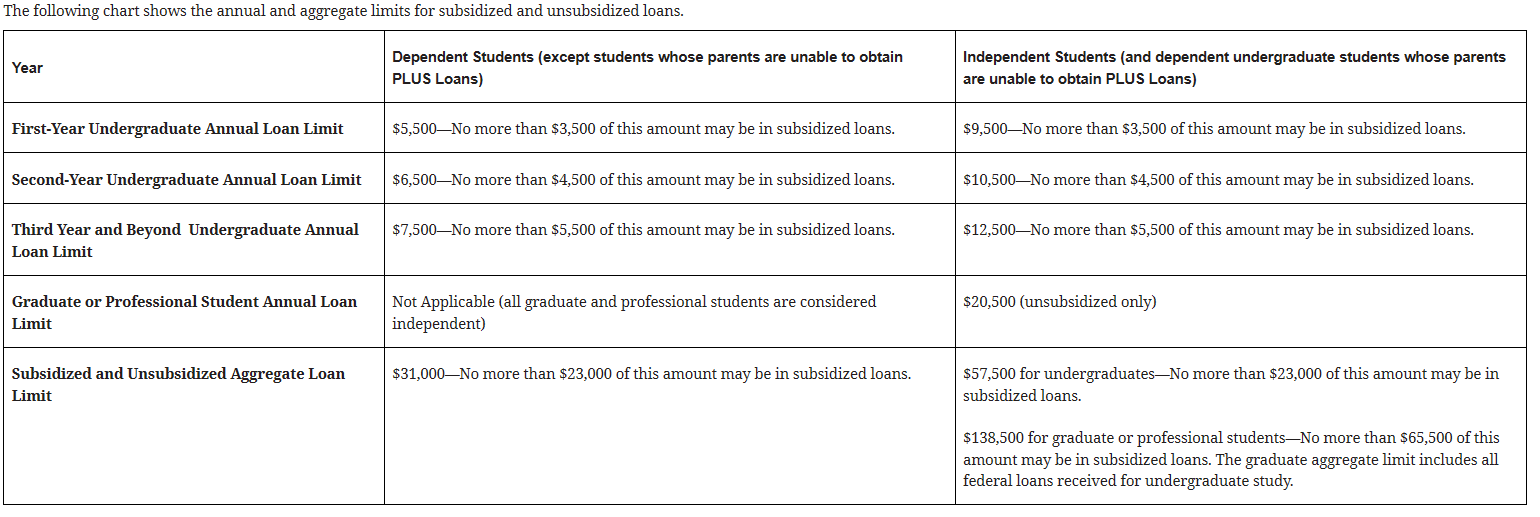

A student’s dependency status (either Dependent or Independent) determines how much their annual loan limit would be. When completing the FAFSA (Free Application for Federal Student Aid), the answers the student provides will determine whose information will be reported.

Federal student loans have many benefits in addition to helping pay college expenses. These include fixed interest rates, no credit check required and flexible repayment plans. Below are a few tips to consider when accepting student loans as part of your financial aid package:

Federal student loans have many benefits in addition to helping pay college expenses. These include fixed interest rates, no credit check required and flexible repayment plans. Below are a few tips to consider when accepting student loans as part of your financial aid package:

- Only borrow what you need and keep track of what you are borrowing. Remember, once you graduate, fall below half-time and exceed your 6 month grace period, you will be required to start making monthly payments.

- Research what your future entry salary will be in your field and try to limit your student loan debt to that annual amount.

- Be a responsible borrower. While paying back your student loans can be an excellent way of building good credit, defaulting on your student loan payments can be disastrous. Missed payments can lead to additional fees, added interest and wage garnishment.